colorado estate tax exemption

CA SOS file no. Boulder is preparing an ordinance that would exempt products that do not contain nicotine or tobacco from the citys 40 sales tax on electronic smoking devices.

2020 Estate Planning Update Helsell Fetterman

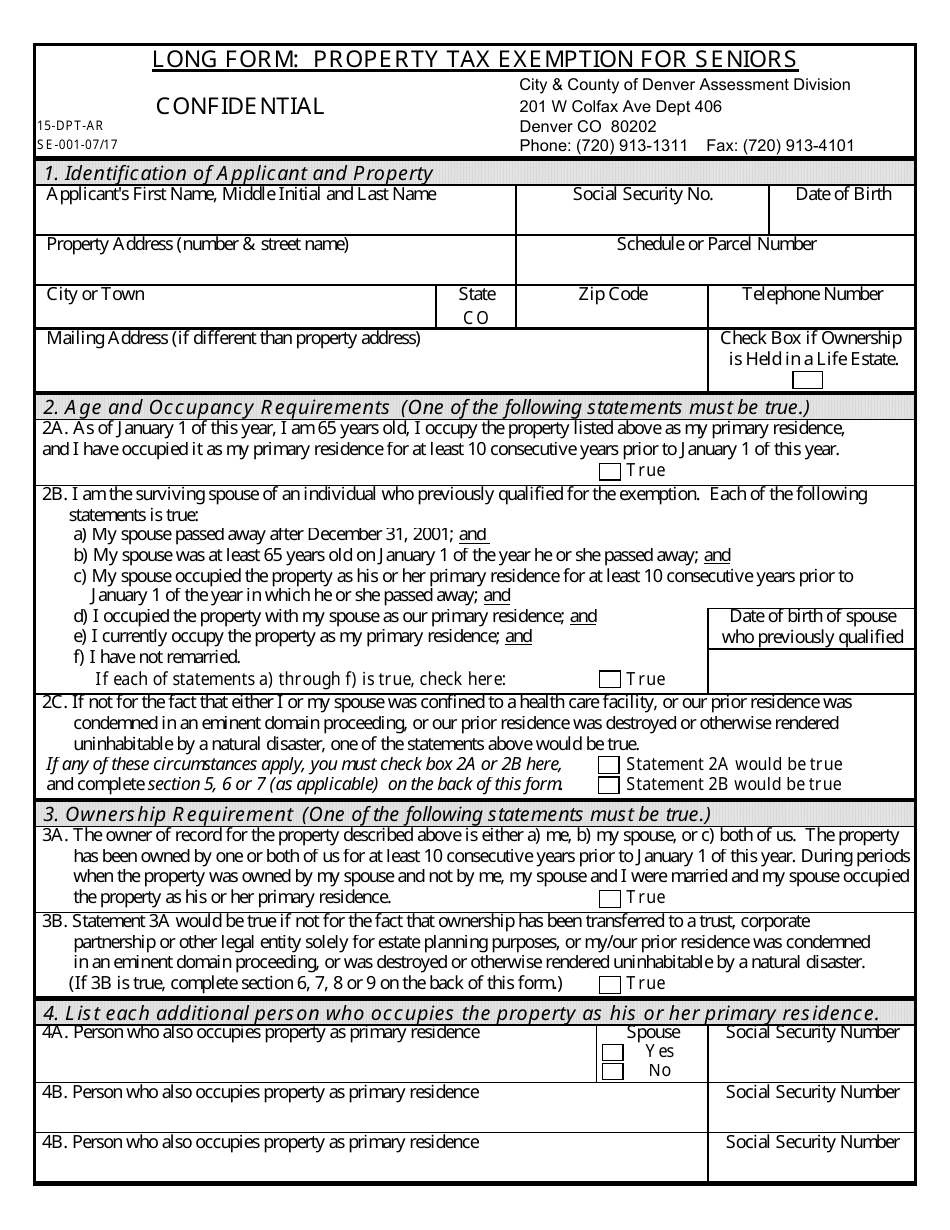

The Senior Exemption is an additional property tax benefit available to home owners who meet the following criteria.

. Exemption Limited to Every Two Years. That means that if the right legal steps are taken a married couple can protect up. One of the more generous aspects of Canadian taxation is the Lifetime Capital Gains Exemption LCGEFor the 2020 tax year if you sold Qualified Small Business Corporation Shares QSBCS your gains may be eligible for the 883384 exemptionHowever you need to submit the appropriate form and documentation as the exemption is not automatic.

The homestead exemption is a legal regime to protect the value of the homes of residents from property taxes creditors and circumstances that arise from the death of the homeowners spouse. For diapers families spend approximately 75 per month per child. Total Household Adjusted Gross Income for everyone who lives on the property cannot exceed statutory limits.

Business name First name. There is an exemption from property tax for business personal property that is less than a certain amount which increases with inflation. What Is the Estate Tax.

For tax years beginning on January 1 2023 the amount of the exemption will. To qualify for the home sale capital gains tax exemption you must pass the use test looking at. Property taxes are quite possibly the most widely unpopular taxes in.

HB 1312 increases this exemption from 7 700 to 50000 for tax years beginning on January 1 2021 and January 1 2022. Eligibility criteria for the Colorado Property Tax exemption are broad. You can only qualify for the home sale exemption from the capital gains tax once every two years.

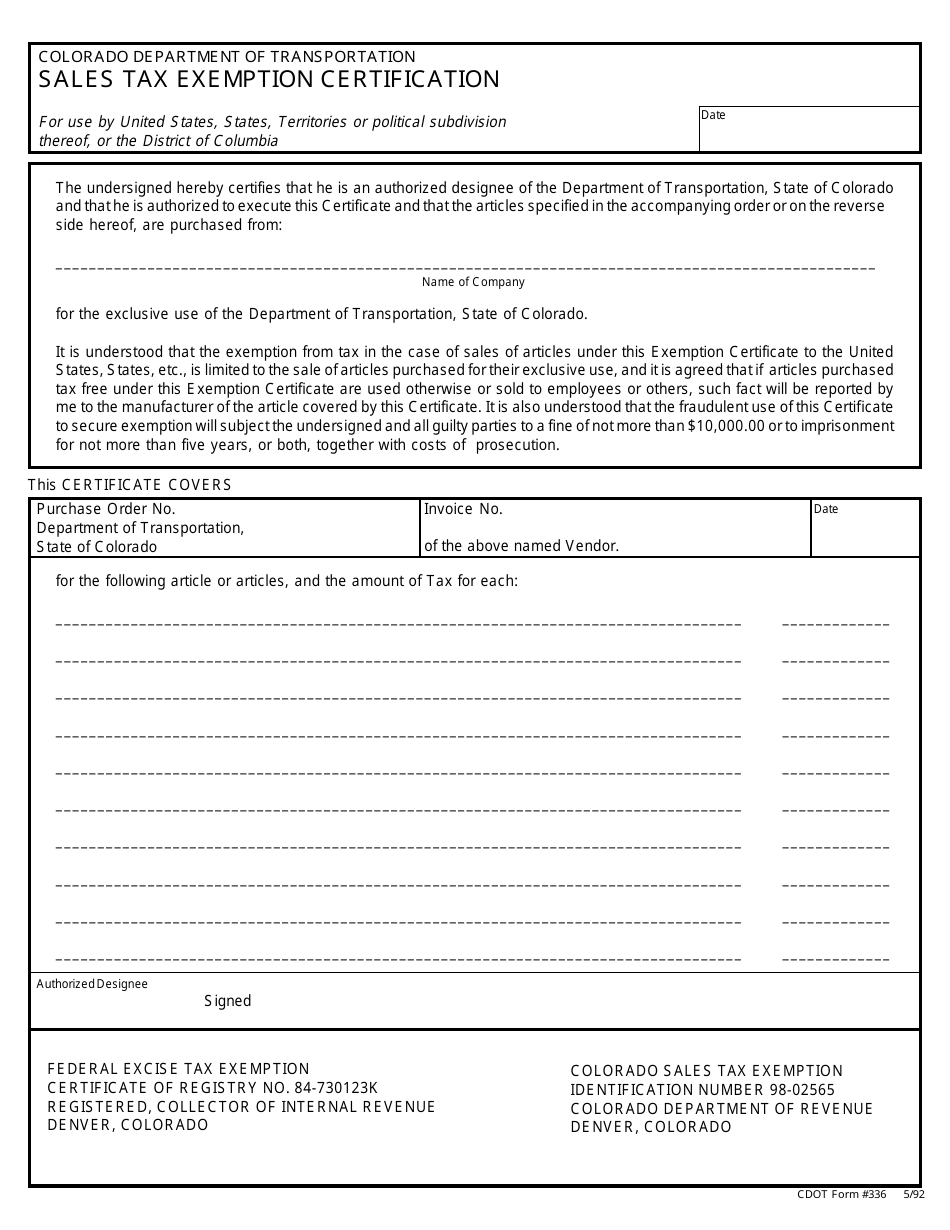

The Colorado Business Personal Property tax is a levy on Business Personal Property used in a business or organization. For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40. State and Local Structure and Administration Washington DC Urban Institute Press 1994 2 nd ed 15.

There are actually twelve states along with the District of Columbia that levy an estate tax and most have exemption amounts that are lower than the federal amount. The property must qualify for a homestead exemption. Due and Mikesell actually point out that for full economic efficiency the rate wouldnt be uniform but rather inelastically demanded goods would have a higher rate than those with elastic demands but it.

Are the current property owner of record. The Assessor estimates a value for the property and consolidates the levies. The Treasurer then mails a tax bill to the property owner.

Such laws are found in the statutes or the constitution of many of the states in the United StatesThe homestead exemption in some states of the South has its legal origins in the. Arizona for example provides a sales tax exemption for the retail sale of solar energy devices and for the installation of solar energy devices by contractors. At least one homeowner must be 65 years old as of January 1.

At least 65 years old on January 1 of the year in which he or she qualifies. This is sometimes called the two-year rule The Use Test. Texas Comptroller of Public Accounts.

But dont forget estate tax that is assessed at the state level. Colorado seniors are eligible for a property tax exemption if they are. Due and John L.

Trying to work around these laws is tax fraud. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own. If the sales tax exemption was implemented the state estimates it would save Colorado consumers approximately 91 million annually.

Colorado exempts from the states sales and use tax all sales storage and use of components used in the production of alternating current electricity from a renewable energy source. It is one of 38 states with no estate tax. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022.

_____ REEP Qualified Intermediary BuyerTransferee Other_____ FEIN CA Corp no. Real Estate Withholding Tax Statement 2021 Form 593 Real Estate Withholding Statement TAXABLE YEAR 2021 AMENDED. There is no estate tax in Colorado.

Have been the primary occupant for at least ten consecutive years prior to January 1. CALIFORNIA FORM Real Estate Withholding Statement Part I Remitter Information 593 Escrow or Exchange No. This tax is portable for married couples.

The effort is meant to clarify. The procedure for applying this tax is similar to that used for real property. Colorado Estate Tax.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Estate Tax Do I Need To Worry Brestel Bucar

2020 Estate Planning Update Helsell Fetterman

A New Era In Death And Estate Taxes

Colorado Estate Tax Everything You Need To Know Smartasset

Sales And Use Tax In Colorado Manufacturing Sales Tax Exemption With New Public Service Case Report Lorman Education Services

Colorado Estate Tax Everything You Need To Know Smartasset

Recent Changes To Estate Tax Law What S New For 2019

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Orange Book Forms Colorado Estate Planning Forms 8th Edition Includes 2018 2021 Updates Cle

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

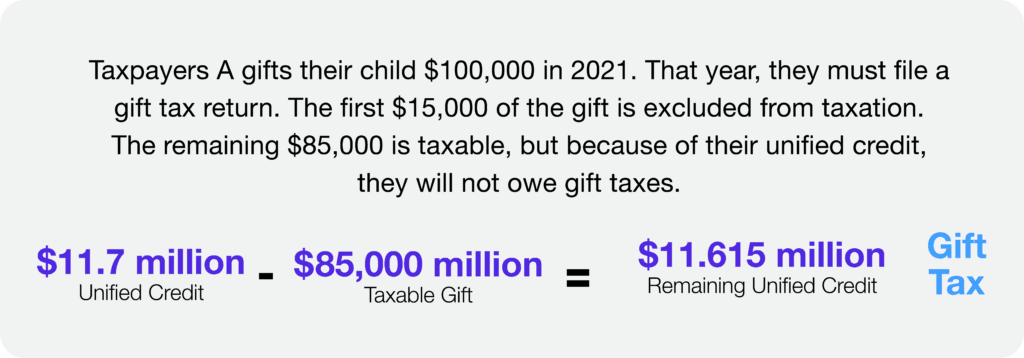

Cdot Form 336 Download Printable Pdf Or Fill Online Sales Tax Exemption Certification Colorado Templateroller

Talk To Clients About Estate Taxes Lifetime Gifts Corvee

Form 15 Dpt Ar Download Printable Pdf Or Fill Online Long Form Property Tax Exemption For Seniors Colorado Templateroller

Colorado Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die